basilh@virginia.edu

@basilhalperin

Edit: The critique in this post – that NGDP targeting cannot achieve zero inflation in the long run without discretion – is somewhat tempered by my 2017 follow-up here: perhaps zero long-run inflation would be inferior to a long-run Friedman rule; which in fact can be naturally implemented with NGDP targeting.

Summary:

I want to discuss a problem that I see with nominal GDP targeting: structural growth slowdowns. This problem isn't exactly a novel insight, but it is an issue with which I think the market monetarist community has not grappled enough.

I. A hypothetical example

Remember that nominal GDP growth (in the limit) is equal to inflation plus real GDP growth. Consider a hypothetical economy where market monetarism has triumphed, and the Fed maintains a target path for NGDP growing annually at 5% (perhaps even with the help of a NGDP futures market). The economy has been humming along at 3% RGDP growth, which is the potential growth rate, and 2% inflation for (say) a decade or two. Everything is hunky dory.

But then – the potential growth rate of the economy drops to 2% due to structural (i.e., supply side) factors, and potential growth will be at this rate for the foreseeable future.

Perhaps there has been a large drop in the birth rate, shrinking the labor force. Perhaps a newly elected government has just pushed through a smorgasbord of measures that reduce the incentive to work and to invest in capital. Perhaps, most plausibly (and worrisomely!) of all, the rate of innovation has simply dropped significantly.

In this market monetarist fantasy world, the Fed maintains the 5% NGDP path. But maintaining 5% NGDP growth with potential real GDP growth at 2% means 3% steady state inflation! Not good. And we can imagine even more dramatic cases.

II. Historical examples

Skip this section if you're convinced that the above scenario is plausible

Say a time machine transports Scott Sumner back to 1980 Tokyo: a chance to prevent Japan's Lost Decade! Bank of Japan officials are quickly convinced to adopt an NGDP target of 9.5%, the rationale behind this specific number being that the average real growth in the 1960s and 70s was 7.5%, plus a 2% implicit inflation target.

Thirty years later, trend real GDP in Japan is around 0.0%, by Sumner's (offhand) estimation and I don't doubt it. Had the BOJ maintained the 9.5% NGDP target in this alternate timeline, Japan would be seeing something like 9.5% inflation today.

Counterfactuals are hard: of course much else would have changed had the BOJ been implementing NGDPLT for over 30 years, perhaps including the trend rate of growth. But to a first approximation, the inflation rate would certainly be approaching 10%.

Or, take China today. China saw five years of double digit real growth in the mid-2000s, and not because the economy was overheating. I.e., the 12.5% and 14% growth in real incomes in China in 2006 and 2007 were representative of the true structural growth rate of the Chinese economy at the time. To be conservative, consider the 9.4% growth rate average over the decade, which includes the meltdown in 2008-9 and a slowdown in the earlier part of the decade.

Today, growth is close to 7%, and before the decade is up it very well could have a 5 handle. If the People's Bank had adopted NGDP targeting at the start of the millennium with a 9.4% real growth rate in mind, inflation in China today would be more than 2 percentage points higher than what the PBOC desired when it first set the NGDP target! That's not at all trivial, and would only become a more severe issue as the Chinese economy finishes converging with the developed world and growth slows still further.

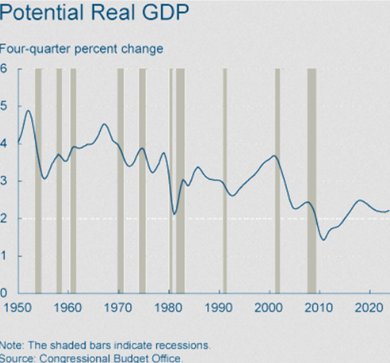

This isn't only a problem for countries playing catch-up to the technological frontier. France has had a declining structural growth rate for the past 30 years, at first principally because of declining labor hours/poor labor market policies and then compounded by slowing productivity and population growth. The mess that is Russia has surely had a highly variable structural growth rate since the end of the Cold War. The United States today, very debatably, seems to be undergoing at least some kind of significant structural change in economic growth as well, though perhaps not as drastic.

Source: Margaret Jacobson, "Behind the Slowdown of Potential GDP"

III. Possible solutions to the problem of changing structural growth

There are really only two possible solutions to this problem for a central bank to adopt.

First, you can accept the higher inflation, and pray to the Solow residual gods that the technological growth rate doesn't drop further and push steady state inflation even higher. I find this solution completely unacceptable. Higher long term inflation is simply never a good thing; but even if you don't feel that strongly, you at least should feel extremely nervous about risking the possibility of extremely high steady state inflation.

Second, you can allow the central bank to periodically adjust the NGDP target rate (or target path) to adjust for perceived changes to the structural growth rate. For example, in the original hypothetical, the Fed would simply change its NGDP target path to grow at 4% instead of 5% as previously so that real income grows at 2% and inflation continues at 2%.

IV. This is bad – and particularly bad for market monetarists

This second solution, I think, is probably what Michael Woodford, Brad DeLong, Paul Krugman, and other non-monetarist backers of NGDP targeting would support. Indeed, Woodford writes in his Jackson Hole paper, "It is surely true – and not just in the special model of Eggertsson and Woodford – that if consensus could be reached about the path of potential output, it would be desirable in principle to adjust the target path for nominal GDP to account for variations over time in the growth of potential." (p. 46-7) Miles Kimball notes the same argument: in the New Keynesian framework, an NGDP target rate should be adjusted for changes in potential.

However – here's the kicker – allowing the Fed to change its NGDP target is extremely problematic for some of the core beliefs held by market monetarists. (Market monetarism as a school of thought is about more than merely just NGDP targeting – see Christensen (2011) – contra some.) Let me walk through a list of these issues now; by the end, I hope it will be clear why I think that Scott Sumner and others have not discussed this issue enough.

IVa. The Fed shouldn't need a structural model

For the Fed to be able to change its NGDP target to match the changing structural growth rate of the economy, it needs a structural model that describes how the economy behaves. This is the practical issue facing NGDP targeting (level or rate). However, the quest for an accurate structural model of the macroeconomy is an impossible pipe dream: the economy is simply too complex. There is no reason to think that the Fed's structural model could do a good job predicting technological progress. And under NGDP targeting, the Fed would be entirely dependent on that structural model.

Ironically, two of Scott Sumner's big papers on futures market targeting are titled, "Velocity Futures Markets: Does the Fed Need a Structural Model?" with Aaron Jackson (their answer: no), and "Let a Thousand Models Bloom: The Advantages of Making the FOMC a Truly 'Open Market'".

In these, Sumner makes the case for tying monetary policy to a prediction market, and in this way having the Fed adopt the market consensus model of the economy as its model of the economy, instead of using an internal structural model. Since the price mechanism is, in general, extremely good at aggregating disperse information, this model would outperform anything internally developed by our friends at the Federal Reserve Board.

If the Fed had to rely on an internal structural model adjust the NGDP target to match structural shifts in potential growth, this elegance would be completely lost! But it's more than just a loss in elegance: it's a huge roadblock to effective monetary policymaking, since the accuracy of said model would be highly questionable.

IVb. Rules are better than discretion

Old Monetarists always strongly preferred a monetary policy based on well-defined rules rather than discretion. This is for all the now-familiar reasons: the time-inconsistency problem; preventing political interference; creating accountability for the Fed; etc. Market monetarists are no different in championing rule-based monetary policy.

Giving the Fed the ability to modify its NGDP target is simply an absurd amount of discretionary power. It's one thing to give the FOMC the ability to decide how to best achieve its target, whether than be 2% inflation or 5% NGDP. It's another matter entirely to allow it to change that NGDP target at will. It removes all semblance of accountability, as the Fed could simply move the goalessays whenever it misses; and of course it entirely recreates the time inconsistency problem.

IVc. Expectations need to be anchored

Closely related to the above is the idea that monetary policy needs to anchor nominal expectations, perhaps especially at the zero lower bound. Monetary policy in the current period can never be separated from expectations about future policy. For example, if Janet Yellen is going to mail trillion dollar coins to every American a year from now, I am – and hopefully you are too – going to spend all of my or your dollars ASAP.

Because of this, one of the key necessary conditions for stable monetary policy is the anchoring of expectations for future policy. Giving the Fed the power to discretionarily change its NGDP target wrecks this anchor completely!

Say the Fed tells me today that it's targeting a 5% NGDP level path, and I go take out a 30-year mortgage under the expectation that my nominal income (which remember is equal to NGDP in aggregate) will be 5% higher year after year after year. This is important as my ability to pay my mortgage, which is fixed in nominal terms, is dependent on my nominal income.

But then Janet Yellen turns around and tells me tomorrow, "Joke's on you pal! We're switching to a 4% level target." It's simply harder for risk-averse consumers and firms to plan for the future when there's so much possible variation in future monetary policy.

IVd. Level targeting exacerbates this issue

Further, level targeting exacerbates this entire issue. The push for level targeting over growth rate targeting is at least as important to market monetarism as the push for NGDP targeting over inflation targeting, for precisely the reasoning described above. To keep expectations on track, and thus not hinder firms and households trying to make decisions about the future, the central bank needs to make up for past mistakes, i.e. level target.

However, level targeting has issues even beyond those that rate targeting has, when the central bank has the ability to change the growth rate. In particular: what happens if the Fed misses the level target one year, and decides at the start of the next to change its target growth rate for the level path?

For instance, say the Fed had adopted a 5% NGDP level target in 2005, which it maintained successfully in 2006 and 2007. Then, say, a massive crisis hits in 2008, and the Fed misses its target for say three years running. By 2011, it looks like the structural growth rate of the economy has also slowed. Now, agents in the economy have to wonder: is the Fed going to try to return to its 5% NGDP path? Or is it going to shift down to a 4.5% path and not go back all the way? And will that new path have as a base year 2011? Or will it be 2008?

(Note: I am aware that had the Fed been implementing NGDPLT in 2008 the crisis would have been much less severe, perhaps not even a recession! The above is for illustration.)

(Also, I thank Joe Mihm for this point.)

IVe. This problem for NGDP targeting is analogous to the velocity instability problem for Friedman's k-percent rule

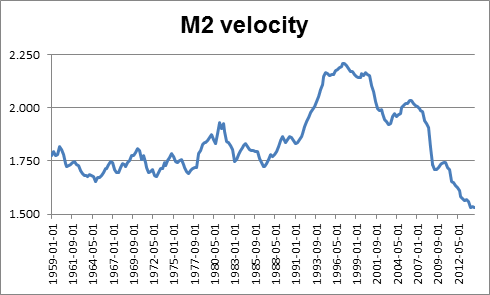

Finally, I want to make an analogy that hopefully emphasizes why I think this issue is so serious. Milton Friedman long advocated that the Fed adopt a rule whereby it would have promised to keep the money supply (M2, for Friedman) growing at a steady rate of perhaps 3%. Recalling the equation of exchange, MV = PY, we can see that when velocity is constant, the k-percent rule is equivalent to NGDP targeting!

In fact, velocity used to be quite stable:

Source: FRED

For the decade and a half or two after 1963 when Friedman and Schwartz published A Monetary History, the rule probably would have worked brilliantly. But between high inflation and financial innovation in the late 70s and 80s, the stable relationship between velocity, income, and interest rates began to break down, and the k-percent rule would have been a disaster. This is because velocity – sort of the inverse of real, income-adjusted money demand – is a structural, real variable that depends on the technology of the economy and household preferences.

The journals of the 1980s are somewhat famously a graveyard of structural velocity models attempting to find a universal model that could accurately explain past movements in velocity and accurately predict future movements. It was a hopeless task: the economy is simply too complex. (I link twice to the same Hayek essay for a reason.) Hence the title of the Sumner and Jackson paper already referenced above.

Today, instead of hopelessly modeling money demand, we have economists engaged in the even more hopeless task of attempting to develop a structural model for the entire economy. Even today, when the supply side of the economy really changes very little year-to-year, we don't do that good of a job at it.

And (this is the kicker) what happens if the predictability of the structural growth rate breaks down to the same extent that the predictability of velocity broke down in the 1980s? What if, instead of the structural growth rate only changing a handful of basis points each year, we have year-to-year swings in the potential growth rate on the order of whole percentage points? I.e., one year the structural growth is 3%, but the next year it's 5%, and the year after that it's 2.5%?

I know that at this point I'm probably losing anybody that has bothered to read this far, but I think this scenario is entirely more likely than most people might expect. Rapidly accelerating technological progress in the next couple of decades as we reach the "back half of the chessboard", or even an intelligence explosion, could very well result in an extremely high structural growth rate that swings violently year to year.

However, it is hard to argue either for or against the techno-utopian vision I describe and link to above, since trying to estimate the future of productivity growth is really not much more than speculation. That said, it does seem to me that there are very persuasive arguments that growth will rapidly accelerate in the next couple of decades. I would point those interested in a more full-throated defense of this position to the work of Robin Hanson, Erik Brynjolfsson and Andrew McAfee, Nick Bostrom, and Eliezer Yudkowsky.

If you accept the possibility that we could indeed see rapidly accelerating technological change, an "adaptable NGDP target" would essentially force the future Janet Yellen to engage in an ultimately hopeless attempt to predict the path of the structural growth rate and to chase after it. I think it's clear why this would be a disaster.

V. An anticipation of some responses

Before I close this out, let me anticipate four possible responses.

1. NGDP variability is more important than inflation variability

Nick Rowe makes this argument here and Sumner also does sort of here. Ultimately, I think this is a good point, because of the problem of incomplete financial markets described by Koenig (2013) and Sheedy (2014): debt is priced in fixed nominal terms, and thus ability to repay is dependent on nominal incomes.

Nevertheless, just because NGDP targeting has other good things going for it does not resolve the fact that if the potential growth rate changes, the long run inflation rate would be higher. This is welfare-reducing for all the standard reasons. Because of this, it seems to me that there's not really a good way of determining whether NGDP level targeting or price level targeting is more optimal, and it's certainly not the case that NGDPLT is the monetary policy regime to end all other monetary policy regimes.

2. Target NGDP per capita instead!

You might argue that if the most significant reason that the structural growth rate could fluctuate is changing population growth, then the Fed should just target NGDP per capita. Indeed, Scott Sumner has often mentioned that he actually would prefer an NGDP per capita target. To be frank, I think this is an even worse idea! This would require the Fed to have a long term structural model of demographics, which is just a terrible prospect to imagine.

3. Target nominal wages/nominal labor compensation/etc. instead!

Sumner has also often suggested that perhaps nominal aggregate wage targeting would be superior to targeting NGDP, but that it would be too politically controversial. Funnily enough, the basic New Keynesian model with wage stickiness instead of price stickiness (and no zero lower bound) would recommend the same thing.

I don't think this solves the issue. Take the neoclassical growth or Solow model with Cobb-Douglas technology and preferences and no population growth. On the balanced growth path, the growth rate of wages = the potential growth rate of the economy = the growth rate of technology. For a more generalized production function and preferences, wages and output still grow at the same rate.

In other words, the growth rate of real wages parallels that of the potential growth rate of the economy. So this doesn't appear to solve anything, as it would still require a structural model.

4. Set up a prediction market for the structural growth rate!

I don't even know if this would work well with Sumner's proposal. But perhaps it would. In that case, my response is... stay tuned for my critique of market monetarism, part two: why handing policymaking over to prediction markets is a terrible idea.

VI. In conclusion

The concerns I outline above have driven me from an evangelist for NGDP level targeting to someone extremely skeptical that any central banking policy can maintain monetary equilibrium. The idea of optimal policy under NGDP targeting necessitating a structural model of the economy disturbs me, for a successful such model – as Sumner persuasively argues – will never be built. The prospect that NGDP targeting might collapse in the face of rapidly accelerating technological growth worries me, since it does seem to me that this very well could occur. And even setting aside the techno-utopianism, the historical examples described above, such as Japan in the 1980s, demonstrate that we have seen very large shifts in the structural growth rate in actual real-world economies.

I want to support NGDPLT: it is probably superior to price level or inflation targeting anyway, because of the incomplete markets issue. But unless there is a solution to this critique that I am missing, I am not sure that NGDP targeting is a sustainable policy for the long term, let alone the end of monetary history.